If you’ve ever watched spend spike at 10 a.m., run out by lunch, and then blamed “Amazon being Amazon,” you already know what the real problem is: PPC doesn’t fail because you lack effort. It fails because the system moves faster than any human can manage across keywords, placements, budgets, and SKUs.

Amazon advertising software exists for one reason - to turn Sponsored Ads from a daily firefight into a controlled, measurable profit engine. The catch is that not all tools solve the same problem. Some are reporting layers. Some are bid bots with a few rules. Some help you build better structure but leave you to babysit the rest.

This is the operator’s view of what matters, what’s optional, and how to pick software that actually reduces wasted spend and improves ACOS and ROAS.

What “amazon advertising software” should really do

At a minimum, software should reduce the number of decisions you have to make manually, without taking away the levers that actually move performance.

If a tool only gives you prettier charts, you’ll still be stuck doing the same work: keyword harvesting, negating, bid changes, placement tweaks, and budget pacing. Helpful? Sure. But the grind stays.

The best amazon advertising software does three things consistently.

First, it systemizes campaign structure so you stop reinventing the wheel for every SKU. Second, it automates the repetitive optimizations that don’t deserve your time (hourly bid adjustments, negative keyword hygiene, budget pacing). Third, it keeps optimization tied to business goals like target ACOS or ROAS, not random rule tinkering.

That’s the difference between “PPC support” and “PPC control.”

Where most accounts leak money (and what software should catch)

Most wasted spend isn’t dramatic. It’s death by a thousand cuts.

The classic one is query drift: broad and auto campaigns keep matching into irrelevant or low-intent searches, and nobody negates fast enough. Another is bid staleness: you set bids based on last week’s data, but auctions shift daily and your competitors aren’t waiting. Then there’s budget misallocation: a hero ASIN runs out of budget mid-day while a mediocre campaign quietly burns cash.

Software should catch these leaks automatically, but only if it’s designed around the real mechanics of Sponsored Products, Sponsored Brands, and Sponsored Display.

You want a system that’s always watching search terms, always watching conversion rate and CPC changes, and always watching budget pacing against performance. If the tool updates once per day, you’re already behind.

The features that actually move ACOS and ROAS

Feature checklists are easy to sell and easy to regret. What matters is whether the feature changes outcomes.

Bid optimization that follows your goal, not your feelings

Manual bidding usually fails in two ways: it’s too slow, or it’s too emotional. You drop bids everywhere after a bad day, then wonder why sales fell off a cliff.

Look for machine-driven bid optimization that can be set to a clear target (ACOS or ROAS) and that updates frequently enough to matter. Hourly adjustments are a different category than “daily rules.” Frequency matters because auctions are volatile, and your account shouldn’t wait until tomorrow to react.

Trade-off: more frequent optimization can also create volatility if the system overreacts to noisy data. The best tools handle this with smoothing, minimum data thresholds, and controls for aggressiveness.

Automated negative keyword and ASIN management

Negatives are where profit hides. They’re also where time goes to die.

Software should help you identify search terms and product targets that reliably spend without converting, then apply negatives safely. Ideally it distinguishes between “needs more data” and “clearly waste,” because premature negation can strangle discovery.

Trade-off: full automation can be risky if your catalog has edge cases (seasonality, variant attribution quirks, or low-volume products). You want the ability to review, set thresholds, and whitelist terms that matter.

Keyword discovery that’s tied to actions

Discovery without execution is trivia.

A tool should turn winning search terms into exact keywords, slot them into the right campaigns, and adjust bids based on performance. If it just dumps a list into a report, you’ll end up copy-pasting at midnight and calling it “optimization.”

Budget pacing and reallocation

Budget is a lever. Pacing is the discipline.

Good software watches the day and the week, preventing campaigns from burning out early while ensuring your best performers don’t get throttled. Better software reallocates based on marginal return - pushing dollars into the campaigns that are beating target and pulling back where you’re donating margin.

Trade-off: aggressive reallocation can starve learning campaigns. Look for controls that let you protect exploration while still prioritizing profit.

Placement controls that reflect how shoppers buy

Top of search, product pages, rest of search - these behave differently. Your ACOS targets should reflect that.

If a tool treats placements as a single blended performance number, you’re blind. You want placement multipliers or bid adjustments that can be tuned per campaign type and goal.

Day-parting (with the right expectations)

Day-parting can be a real lever, especially if your conversion rate swings by time of day or if you routinely burn budget before peak hours.

But it’s not magic. If your listing is weak or your bids are misaligned, turning ads off at 2 a.m. won’t save you.

Use day-parting when you have enough data to see consistent performance patterns and when your budget constraints are real. Otherwise, keep it simple.

Analytics that operators actually use

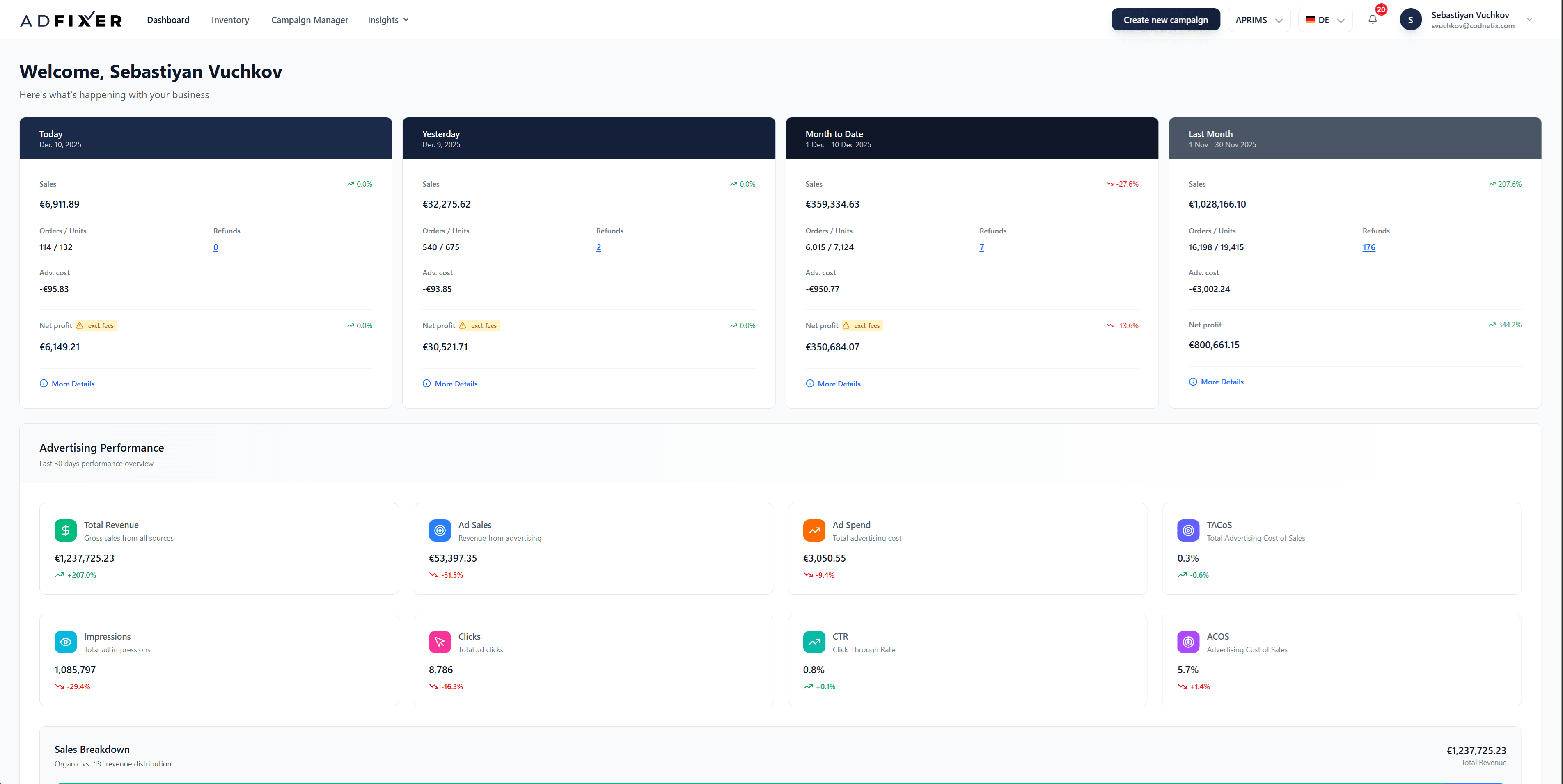

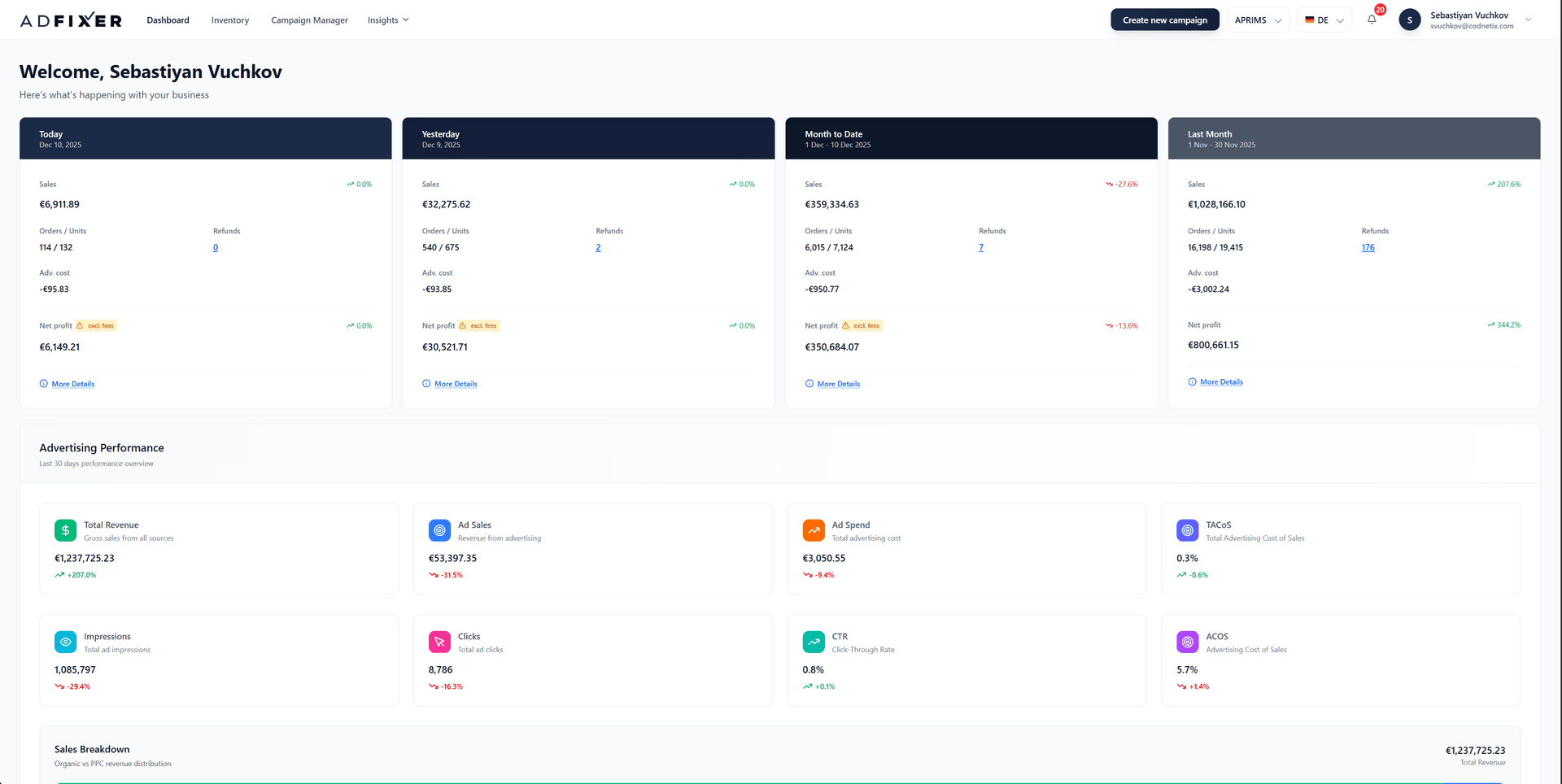

The best dashboard isn’t the prettiest one. It’s the one that answers the questions you ask every week:

Are we on target ACOS or ROAS?

Where is profit coming from - by SKU, campaign type, and placement?

What’s scaling cleanly, and what’s scaling with hidden inefficiency?

Software should show spend, revenue, ACOS, ROAS, and profit in a way that lets you take action. Profit is the key word. Plenty of tools stop at ad-attributed sales and leave you guessing on margin impact.

Self-serve vs managed: the real decision

Your choice isn’t just “which software.” It’s “who owns the outcomes.”

Self-serve works when you have someone who understands Amazon PPC mechanics and can make strategic calls - which products to push, when to accept higher ACOS for ranking, how to interpret new-to-brand signals in Sponsored Brands, how to think about TACOS.

Managed service makes sense when you have spend and complexity but not enough internal bandwidth. If you’re running multiple product lines, launching frequently, or dealing with wholesale and retail dynamics, execution becomes a job, not a task.

The best setups let you start self-serve and bring in help when you hit a ceiling. That “escape hatch” matters because PPC doesn’t pause when your team gets busy.

Questions to ask before you pick a tool

If you want a tool that pays for itself, ask questions that force clarity.

How often does it adjust bids - and what signals does it use?

Can you optimize toward a target ACOS or ROAS at the campaign or portfolio level?

How does it handle search term harvesting and negatives? Is it automated, review-based, or both?

Does it help you build and maintain campaign structure (not just optimize what you already built)?

How does it treat placements and day-parting?

Can you see performance in terms of profit, not just ad revenue?

And the practical one: how quickly can you get from “connected account” to “better performance”? If onboarding takes weeks, you’re paying in opportunity cost.

What implementation should look like (if you want results fast)

Most teams fail here. They buy software and then run it like a reporting tool.

Implementation should start with goals, not features. Set targets by product group - not every SKU deserves the same ACOS. A new launch might tolerate higher ACOS for velocity, while a mature cash-cow should defend margin.

Then fix structure. If your campaigns are a junk drawer, automation will optimize chaos. Guided templates or funnels help because they standardize how you separate discovery from performance, how you isolate match types, and how you keep budgets from cannibalizing each other.

Then turn on automation in controlled stages. Start with bid optimization and search term management where you have enough data. Protect learning campaigns with guardrails. Watch the first two weeks like a hawk, because the software will surface issues you didn’t know you had - like campaigns that only perform on one placement or products that can’t convert at any bid.

Once stable, scale by adding SKUs and expanding keyword coverage, not by cranking budgets blindly.

A note on AdFixer

If you want an operator-first platform that combines guided campaign funnels with always-on optimization (including frequent bid updates), plus the option to hand execution to a dedicated expert when you’re stretched thin, AdFixer is built for exactly that problem set.

The trade-offs nobody advertises

Automation doesn’t remove strategy. It removes busywork.

A tool can’t fix a product that doesn’t convert, pricing that’s out of market, or a listing that’s missing the basics. It also can’t decide whether you’re playing a ranking game or a profitability game this month - you have to set that intent.

And if you’re in a highly seasonal category or you run frequent promos, any system needs context. The right software gives you controls to adapt without forcing you back into spreadsheet mode.

The goal isn’t to “set it and forget it.” The goal is to stop wasting human time on tasks that software can do better, so your team can focus on the few decisions that actually compound.

If you judge amazon advertising software by one standard, make it this: does it reduce your weekly workload while improving target alignment on ACOS or ROAS? If the answer isn’t a clear yes, keep looking - your margin is too expensive to manage manually forever.