You can have the cleanest keyword list in your account and still bleed profit because placements are doing whatever they want.

If your Search Term Report looks fine but ACOS keeps creeping up, placement mix is usually the silent culprit. Top of Search can spike CPCs fast. Product Pages can quietly eat budget without converting. Rest of Search can look “efficient” while starving your best traffic. Amazon placement optimization is where you take that chaos and turn it into something you can actually control.

What “placement” really means in Amazon PPC

Amazon gives you three placement buckets in Sponsored Products (and a similar concept in Sponsored Brands):

Top of Search (first page, top rows), Product Pages (detail pages), and Rest of Search (everything else in search results).

These buckets don’t just change where you show up. They change shopper intent, competition level, conversion rate, and the kind of clicks you’re paying for. Top of Search often has the highest intent and the highest competition. Product Pages can be prime real estate for defensive and conquesting plays, but it’s also where curiosity clicks happen. Rest of Search is the long tail: cheaper, messier, sometimes great, sometimes a sinkhole.

Placement modifiers are simple on paper: increase your bid by X% for a placement. In practice, they’re leverage. They can either concentrate spend where your conversion rate is highest or amplify your worst traffic and blow up ACOS.

When placement optimization actually matters (and when it doesn’t)

Placement work pays off most when you have enough data to trust the differences between placement buckets. If a campaign has 20 clicks total, you’re not doing optimization - you’re guessing.

It also matters more in categories where Top of Search is a pay-to-play battlefield. If competitors are aggressive and your product converts well, winning Top of Search can be the fastest path to scale. If your conversion rate is average or your listing is weak, forcing more Top of Search traffic usually just means paying premium CPCs for “almost” buyers.

And sometimes it doesn’t matter as much. If your SKU is low price with thin margin, or you’re in a niche with limited competition, placement modifiers might move the needle less than fixing targeting, creative, or pricing. The point is not to tweak every lever. It’s to push the one that changes profit.

The placement optimization workflow that operators use

The clean way to do this is not “set 100% Top of Search and hope.” The clean way is to treat placement as a measured bet tied to a goal.

Step 1: Start with a target, not a hunch

Pick the KPI you actually manage to: target ACOS or target ROAS. Then decide what “success” means by placement.

For example, you might accept a higher ACOS on Top of Search if it drives more new-to-brand volume or lifts organic rank, but you would demand a lower ACOS on Product Pages because it’s typically less predictable. That’s a legitimate trade-off - as long as it’s intentional.

Step 2: Pull placement performance the right way

Look at the Placement report at the campaign level first, then drill into ad groups or targets only if you have volume.

You’re comparing, by placement: CPC, CVR, ACOS (or ROAS), and conversion volume. Don’t optimize placements on “one sale” data. A placement that has 2 orders can look magical or terrible by accident.

A practical threshold: if a placement bucket has at least 10-15 conversions in the period you’re analyzing, you can start trusting it. If it has fewer, keep modifiers conservative.

Step 3: Decide which placement earns more aggression

This is where operators get paid: reading the intent signals and deciding what to lean into.

If Top of Search ACOS is better than campaign average (or ROAS is higher) and your budget caps out early, you have a strong case to increase Top of Search modifier and raise budget to capture more of that traffic.

If Top of Search ACOS is worse but CVR is higher, your issue might be CPC inflation. In that case, you don’t necessarily turn off Top of Search - you bring base bids down, tighten targeting, and let the modifier concentrate spend on the best queries rather than spraying.

If Product Pages are expensive with weak CVR, it can mean you’re showing up on irrelevant ASINs (or your product isn’t compelling next to the competitor’s offer). You fix that with better ASIN targeting and negative product targeting, not by blindly cutting all Product Pages exposure.

Step 4: Adjust base bids and placement modifiers together

A common mistake is treating the placement multiplier like a separate universe. It’s not. It stacks on top of your base bid.

If you crank Top of Search to +200% and your base bid is already aggressive, you’ve basically told Amazon, “Take whatever you want.” Your CPCs will obey.

A more controlled approach is to set base bids for “acceptable” traffic in Rest of Search, then use the placement modifier as an intentional boost for the placements that prove they deserve it.

Step 5: Re-check after budget and day-parting changes

Placements don’t exist in a vacuum. If you add day-parting (or change budgets), you can shift placement mix without touching modifiers.

Example: you restrict ads to peak hours when competition is highest. Your Top of Search impression share might drop or your CPCs might jump. Same keyword, same bid, different auction environment. Placement optimization is not a one-time set-and-forget. It’s a control loop.

Practical scenarios (and what to do)

Here’s what placement patterns usually mean in real accounts.

Scenario A: Top of Search has great ROAS, low spend

You’re under-serving your best traffic. If your product converts and margins support it, increase Top of Search placement modifier in steps, not leaps, and raise the campaign budget so you don’t cap out.

Watch one thing closely: does CPC rise faster than sales volume? If yes, you found the saturation point. Back off slightly and reallocate to other campaigns rather than paying for ego placements.

Scenario B: Top of Search eats spend and ACOS spikes

This often happens when broad or auto campaigns are allowed to compete at premium placements. The fix is rarely “reduce Top of Search to 0%.” The fix is to isolate.

Move your highest-intent terms into exact match campaigns where you can afford Top of Search. Keep discovery (auto/broad) campaigns more conservative on Top of Search so you’re not paying premium CPCs to learn what you could learn cheaper.

Scenario C: Product Pages drives clicks, not orders

Either you’re on the wrong ASINs or your offer loses the comparison. Tighten product targeting to the ASINs where you actually belong: comparable price, comparable review strength, clear differentiator.

Also decide whether you’re playing defense or offense. Defensive Product Pages (your own ASINs) can be worth paying for even at a slightly worse ACOS if it prevents leakage to competitors. Offensive conquesting needs stricter profitability rules because it’s easy to spend a lot to win very little.

Scenario D: Rest of Search looks “efficient” but sales are flat

Rest of Search can be cheap, but it can also be low volume. If you’re stuck in low-impact placements, you might be optimizing for a pretty ACOS while failing to scale.

This is where you test higher Top of Search modifiers on your proven converting targets, but only after you’ve ensured the listing is conversion-ready. Otherwise you’re just buying more expensive traffic to the same weak conversion rate.

The hidden placement lever: campaign structure

Placement controls are campaign-level. That means your structure determines how precise you can be.

If you cram brand defense, competitor conquesting, and category discovery into one campaign, your placement modifier is forced to be a compromise. You’ll either underbid your best targets or overpay for your worst ones.

Operators who scale profitably separate by intent. Brand terms get their own campaign. Top converting non-brand exact terms get their own. Discovery stays separate. Product targeting is split between defensive and offensive. Then placement modifiers become a scalpel instead of a blunt instrument.

This is also why “set it and forget it” PPC dies at scale. As soon as you add more SKUs and targets, the placement mix changes. Structure is what keeps placement optimization controllable.

Common mistakes that waste money fast

The quickest ways to torch budget with placements are predictable.

First: maxing out Top of Search modifiers without controlling base bids. Second: optimizing placements on tiny sample sizes. Third: leaving discovery campaigns eligible for premium placements. And fourth: changing modifiers without watching budget caps - if you’re out of budget by 11 a.m., your “optimization” might just be shifting where you lose.

Also, don’t forget that placement performance is downstream of listing quality. If your main image, price, coupon, reviews, and A+ content are not competitive, placement optimization becomes a tax.

Making placement optimization easier to execute

The hard part about placement work isn’t knowing what to do. It’s the operational overhead: pulling reports, calculating deltas, making changes, then checking again next week. Multiply that by 20 campaigns and you’re back to the manual grind.

If you want placement controls to run like a system, you need three things: goal-based bidding (so placement aggression matches target ACOS/ROAS), automation that reacts faster than you can, and a workflow that keeps discovery and performance traffic separated.

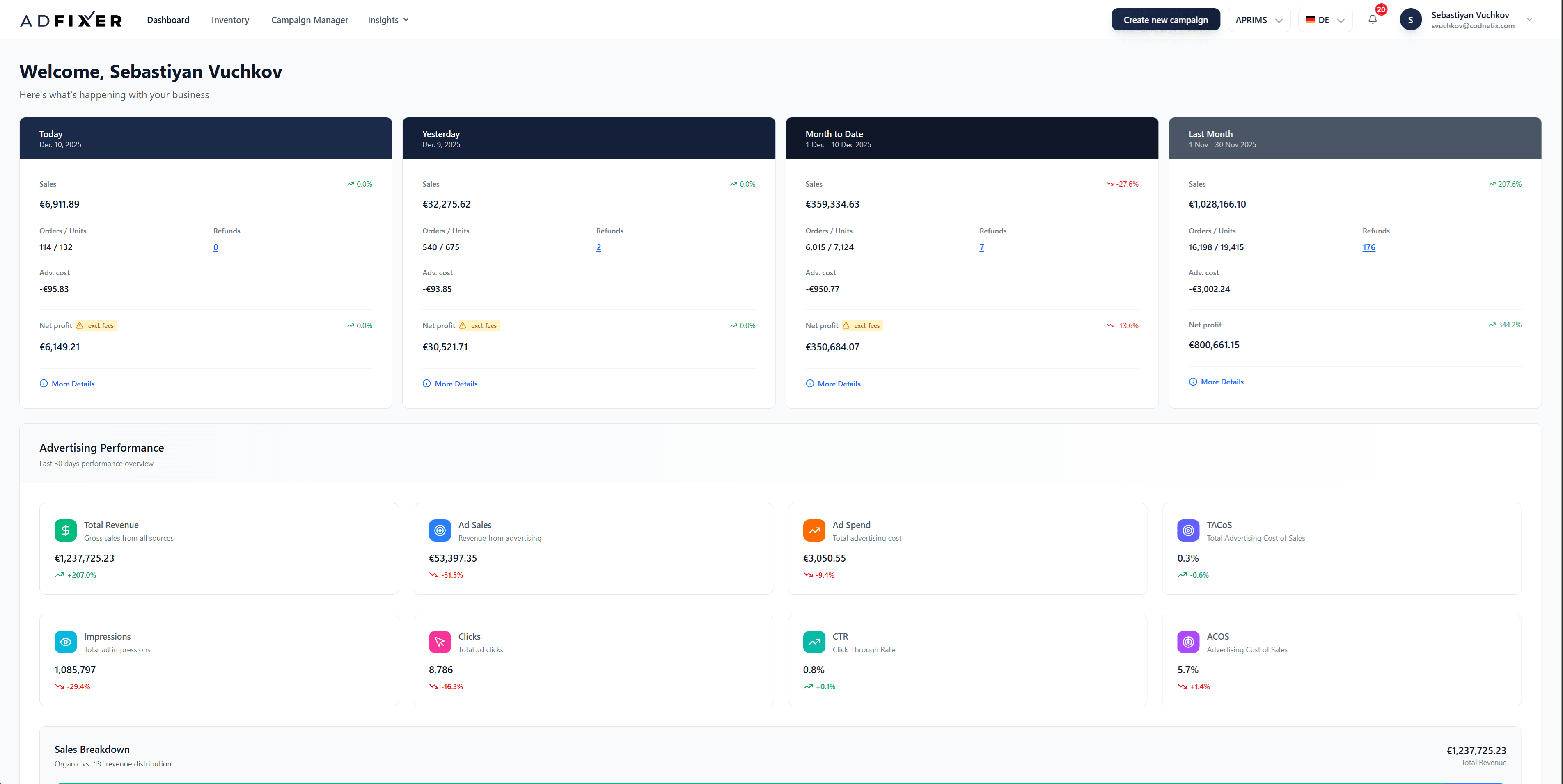

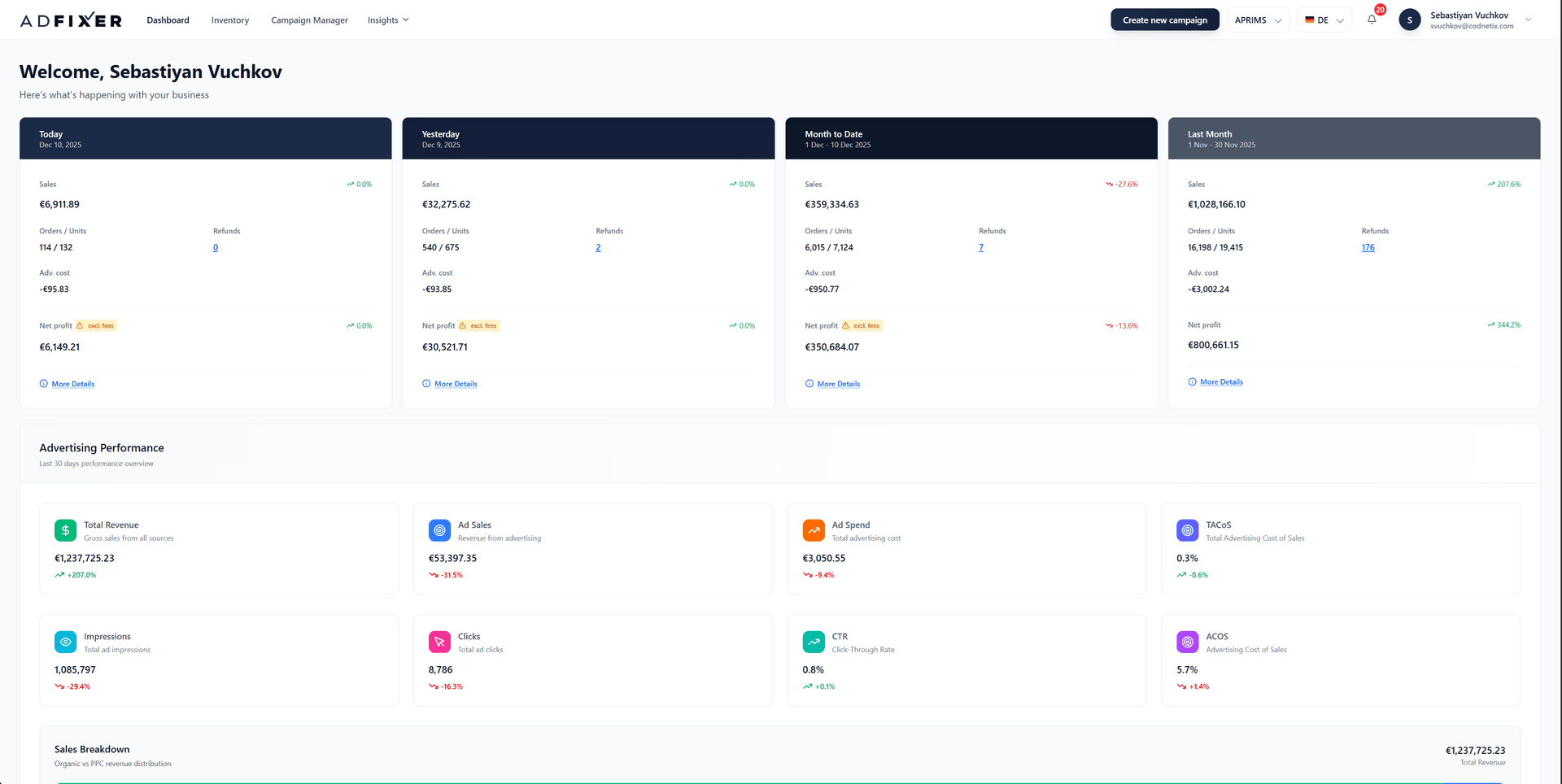

That’s the philosophy behind platforms like AdFixer: always-on optimization (including placement and budget controls) tied to the outcome you care about, not endless rule tinkering.

Placement optimization is one of the few Amazon PPC levers that can change your account’s efficiency and scale at the same time - but only if you treat it like an experiment with guardrails, not a checkbox. The most profitable accounts aren’t the ones with the highest Top of Search multiplier. They’re the ones that can prove, with data, exactly where a higher bid buys real profit and where it buys expensive noise.