You do not have an Amazon ads problem. You have a profit control problem.

If you have meaningful spend, you have seen it: a few keywords carry the account, a few ASINs quietly burn budget, and your “good” ACOS swings the moment Amazon shifts traffic, a competitor changes price, or your inventory dips. That is why amazon ads optimization is less about tinkering with bids and more about building a system that behaves well when conditions change.

This deep dive lays out what actually moves results in Sponsored Products and Sponsored Brands, where the common “best practices” break, and how to run optimization like an operator who cares about margin, not vanity ROAS screenshots.

The real goal of amazon ads optimization

Most teams say they want lower ACOS. What they usually mean is “predictable profitability.” Those are not the same.

A low ACOS can be a trap if it comes from starving campaigns, missing scalable keywords, or over-weighting branded traffic that would have converted anyway. A higher ACOS can be acceptable if it drives profitable new-to-brand growth, protects organic rank, or clears inventory without collapsing unit economics.

So the first decision is not “what’s my target ACOS?” It is “what is this SKU allowed to do?” A hero SKU with strong margin and stable conversion can tolerate growth-oriented spend. A thin-margin SKU or one with limited inventory needs disciplined efficiency. Your optimization strategy should change by SKU role, not by account-wide averages.

Start with structure that creates clean signals

Optimization only works when your data tells the truth. If you blend too many intents, match types, and ASIN behaviors into one campaign, you get noisy performance that is impossible to steer.

At a practical level, clean structure does two things. First, it separates discovery from harvesting so you can spend to learn without letting learning spend pretend it is “profitable.” Second, it isolates levers - bids, negatives, placements, and budgets - so adjustments do not cause side effects you cannot diagnose.

If you are rebuilding from scratch, keep the logic simple: one bucket for exploration (auto and broad), one bucket for proven terms (exact), and one bucket for product targeting. That does not mean you need a hundred campaigns. It means each campaign should have a job that is easy to evaluate.

The trade-off: more structure gives you better control, but it also increases operational load. If your team cannot update bids, harvest terms, and manage negatives consistently, complexity becomes performance debt.

Bids are not the lever - bid timing is

Most sellers think bidding is a number. It is not. It is a response loop.

A bid is only “right” relative to your current conversion rate, your price, your competitors’ aggressiveness, and the specific search results page Amazon is serving that day. That is why weekly bid adjustments often feel like guessing. You are reacting after the market moved.

The highest-leverage move is increasing how frequently you correct bids. Hourly or daily adjustments reduce the time you spend overpaying when CVR dips and underbidding when a term is hot. If you have ever looked at a 7-day report and thought, “This keyword was great Monday and terrible Thursday,” you already know why timing matters.

There is also a ceiling. You cannot bid your way out of a weak detail page. If your conversion rate is unstable due to price, reviews, imagery, or out-of-stock variations, bid optimization will oscillate. Fix the listing first, then scale bids.

Keyword harvesting: speed beats perfection

Most wasted spend comes from slow learning, not “bad keywords.” You let broad and auto run too long without extracting winners and blocking losers.

A disciplined harvesting workflow is straightforward: when a search term proves it can sell at your target efficiency, move it into exact match and set a deliberate bid based on its own economics. When a term burns spend without a path to conversion, negate it so it stops taxing the budget.

Where teams get stuck is waiting for statistical certainty. You do not need a thesis defense. You need a reasonable trigger. The correct threshold depends on price point and conversion rate. A $15 product with a 10% CVR will need fewer clicks to prove itself than a $90 product with a 3% CVR. The “right” rule is the one that gets you to action before you waste another week of spend.

Negative keywords: the fastest ACOS win

If you want quick improvement, negatives are usually the cleanest lever. Not because they magically create sales, but because they stop paying for the wrong traffic.

The nuance is that negatives should reflect intent, not emotion. Negating “cheap” might make sense for a premium product. Negating “replacement” might hurt if your item is often bought as a replacement part. Start with search terms that clearly mismatch your product, then tighten.

Also, watch for unintentional self-sabotage: exact negatives in the wrong campaigns can block profitable queries across your account. If your structure is messy, your negatives will be messy too.

Placement controls: where you pay more must be earned

Amazon placements are not a vanity setting. They are a pricing model.

Top of Search often converts better, but it also costs more. Product Pages can be cheaper, but intent can vary wildly depending on which ASIN pages you show on. Rest of Search can be a volume play, but it can also be where your spend goes to die if you are not harvesting terms.

The operator move is to treat placement multipliers like a performance contract. If Top of Search delivers stronger conversion at an acceptable CPC-to-margin relationship, you can pay the premium. If it does not, remove the multiplier and let the auction price normalize.

“It depends” shows up hard here. A brand defending its own branded terms may want aggressive Top of Search even at a higher ACOS because the cost of losing that slot is bigger than the ad metric suggests. A challenger brand on generic terms may need to be selective and only push placements where the detail page conversion rate can carry the CPC.

Budget pacing: stop letting Amazon pick your priorities

Daily budgets are not just guardrails. They decide which campaigns get to learn and which get cut off before they find efficiency.

When budgets cap early, Amazon prioritizes what it can spend quickly, not what is most profitable. That often means broad discovery campaigns burn through budget in the morning and your exact campaigns miss the afternoon sales window.

Better pacing is usually about two things: protect proven campaigns with enough budget to run all day, and cap discovery so it cannot consume the entire account. If you day-part (and you should when your conversion rate varies by hour), budgets become even more important because a campaign that runs out at 1 p.m. cannot benefit from the evening bump.

Day-parting: a surgical tool, not a bandage

Day-parting works when you have a repeatable pattern: certain hours consistently produce higher conversion or lower CPC, and your business can fulfill demand without stock issues.

It fails when you use it to hide structural problems. If a campaign only performs at midnight, that is often a signal that your bids are too high during peak competition or your targeting is too broad.

Use day-parting as an efficiency multiplier after you have cleaned up targeting and harvesting. Otherwise you are just turning the lights off in a messy room.

Product targeting: the most under-optimized profit lever

Keyword targeting gets all the attention, but product targeting is where you can create predictable wins, especially for brands with clear competitors and strong differentiation.

Good product targeting is not “target all competitors.” It is selecting ASINs where your offer wins on price, reviews, bundle value, or a specific feature. If your product is meaningfully better, Product Pages placement can convert at a strong ROAS even with modest traffic.

The trade-off is maintenance. Competitor pages change, prices move, and new entrants appear. If you never prune poor-performing ASIN targets, product targeting becomes a slow leak.

Measurement that actually helps decisions

If your reporting is only ACOS and ROAS, you are missing the reasons behind performance.

You need to track at least three layers: search term efficiency (does the query make money), campaign role (is this discovery or scaling), and SKU economics (margin and conversion capacity). When a campaign looks “bad,” the fix depends on which layer is broken.

A discovery campaign with a high ACOS might be doing its job if it is feeding exact match winners. An exact campaign with a rising ACOS is a warning sign because it should be stable. A SKU with worsening conversion rate will drag every campaign down, and no amount of bidding finesse will change that.

When you should automate (and when you should not)

If you are adjusting bids, harvesting keywords, adding negatives, and managing budgets across multiple SKUs, manual work breaks down for a simple reason: you cannot respond fast enough.

Automation is best for repeatable, high-frequency actions like bid updates, search term harvesting, negative keyword rules, placement tuning, and budget pacing. Humans are better for setting strategy - target ACOS by SKU role, deciding how aggressive to be on conquesting, and coordinating ads with pricing, inventory, and promotions.

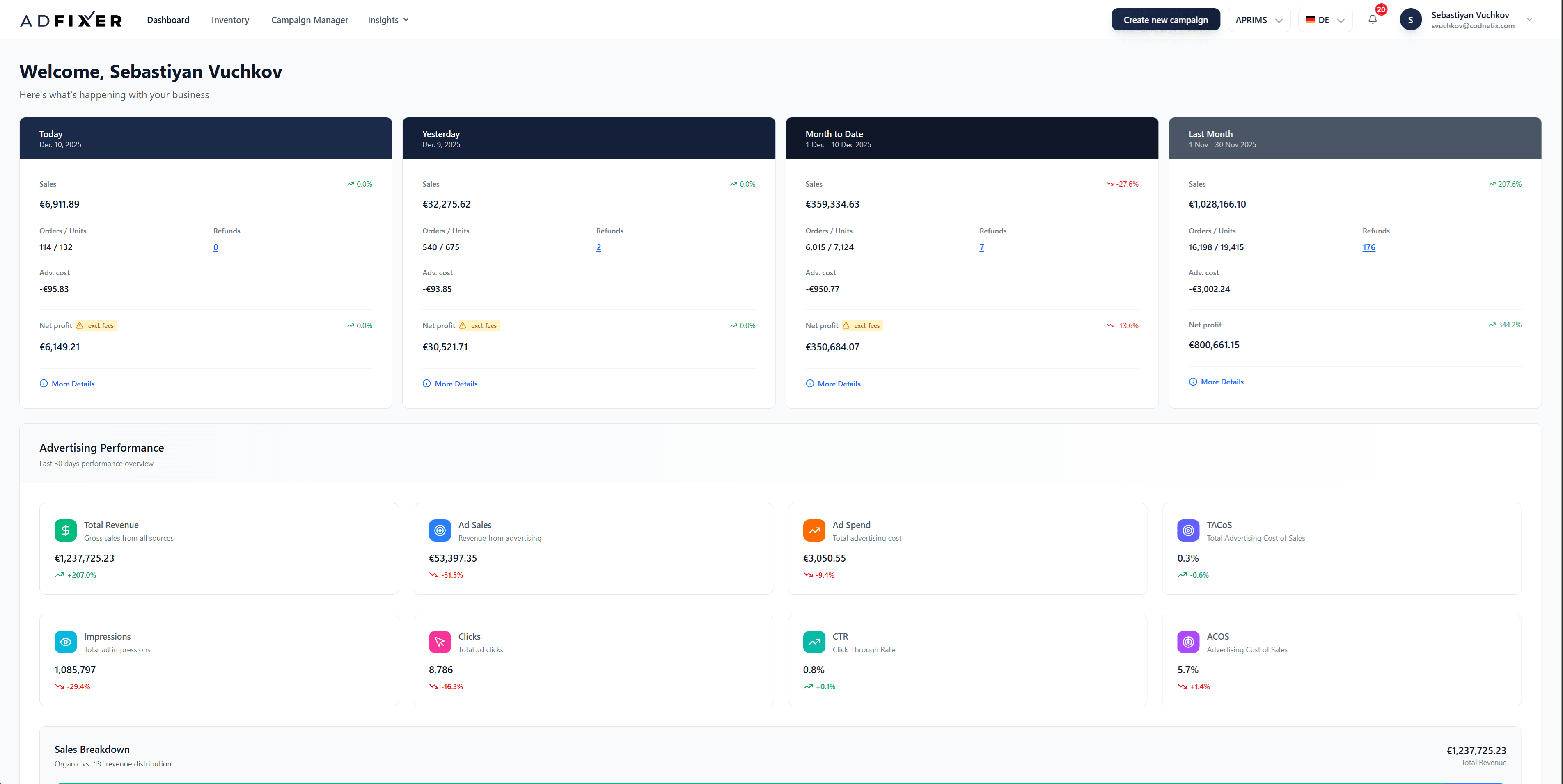

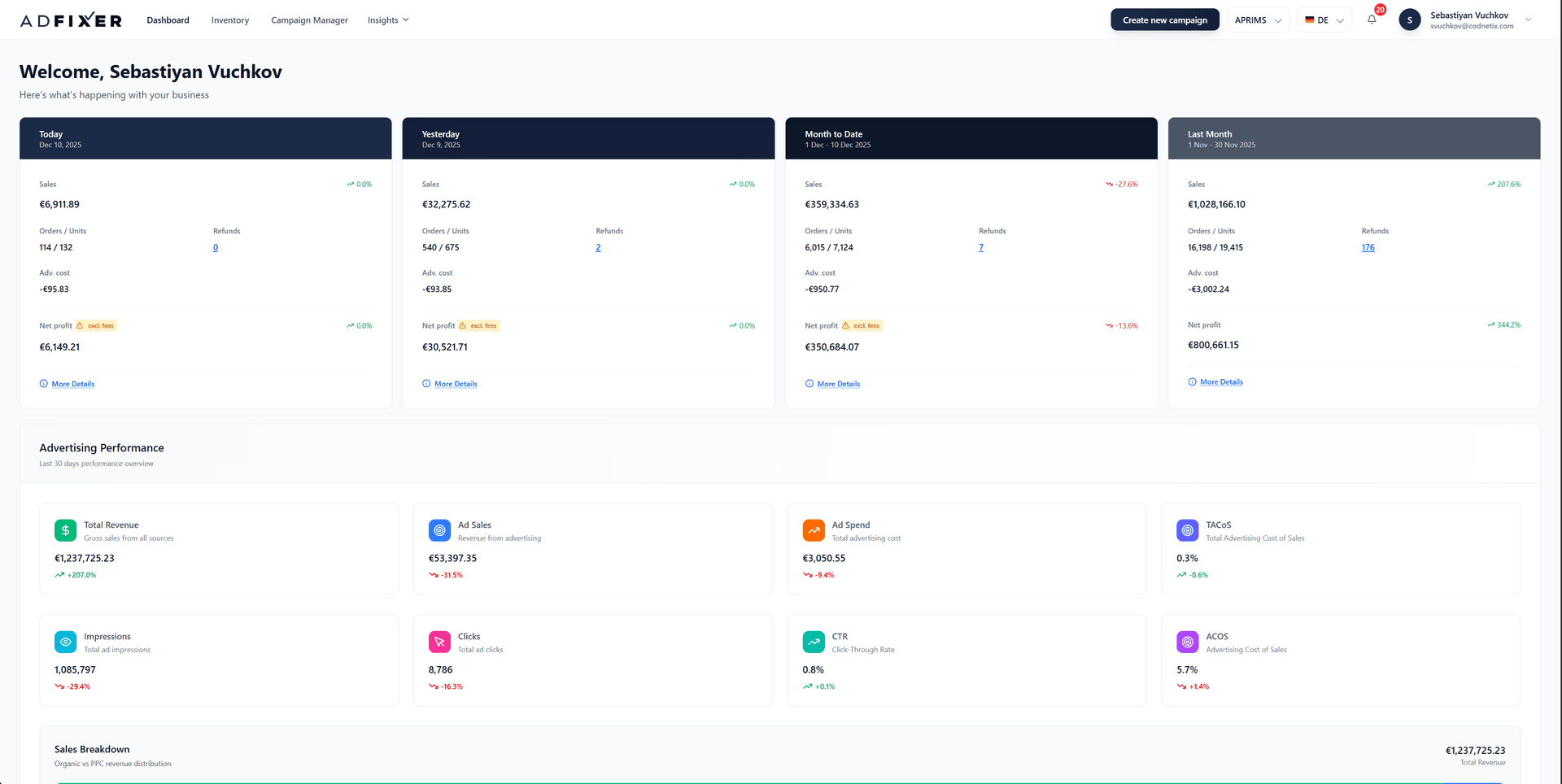

If you want always-on execution without living in spreadsheets, a platform like AdFixer exists specifically for this style of goal-based optimization - set the target, let the system adjust hourly, and keep your attention on what to scale next.

The important caveat: automation cannot rescue a broken catalog. If your detail pages do not convert, your reviews are weak, or you are out of stock, automation will simply optimize you into a smaller and smaller spend level.

The optimization rhythm that keeps accounts healthy

The accounts that stay profitable treat optimization like a rhythm, not a rescue mission. They review search terms often enough to prevent waste, they separate learning from scaling, and they adjust bids frequently enough that performance does not drift for days.

If you build that rhythm, amazon ads optimization stops feeling like firefighting and starts behaving like operations: inputs, controls, outputs. And once it is operational, scaling becomes a decision you make, not a surprise Amazon makes for you.

A useful closing thought to keep on your desk: every ad dollar is either buying profit now or buying information you can turn into profit later. If you cannot name which one it is, that is the next thing to fix.